March Recap and April Outlook

In a notable moment from his testimony to Congress last year, Jerome Powell revealed his 50-year fandom of the Grateful Dead.

In his comments during the March FOMC meeting reaffirmed that rate cuts are on the horizon, although the exact timing remains uncertain. If rates do fall, it will conclude a tightening phase marked by an initially hesitant Powell, who delayed rate hikes despite soaring inflation, followed by a period of unprecedented rate increases. This period has been accompanied by intense speculation around rates, which led to a lot of market volatility.

The volatility in both equity and bond markets seen as inflation soared and rates climbed has eased somewhat. Performance in these markets has rebounded in anticipation of rate cuts, though the timing remains elusive.

As Powell continues to stress, the timing of rate cuts will depend on incoming data. The Fed views the recent stubbornness in inflation as a temporary hurdle but insists inflation must decline further before declaring victory. Strong labor markets also complicate the justification for a rate cut.

Key Economic Data:

– Consumer Price Index (CPI): CPI remained over 3%, with a 3.2% increase for the 12 months through February. Core CPI, excluding food and energy, rose 3.8%, slightly down from January.

– Core Inflation: Now projected to peak at 2.6% in 2024, up from the 2.4% projected in December 2023.

– Growth Projections: Projected to be 2.1% in 2024, up from 1.4% in December.

– Non-Farm Payrolls: Increased by 303,000 jobs in March, surpassing consensus expectations of 200,000 jobs, with estimates ranging from 150,000 to 250,000.

What Does the Data Add Up To?

Markets are experiencing a “goldilocks” moment, with both equities and bonds anticipating rate cuts, even if these cuts are perpetually pushed further into the future.

Many economists, investors, and observers expected the first rate cut at the June FOMC meeting. However, strong labor market data in March makes this less likely. Average hourly earnings rose by 0.3%, up 4.1% over the past year, indicating moderate wage growth.

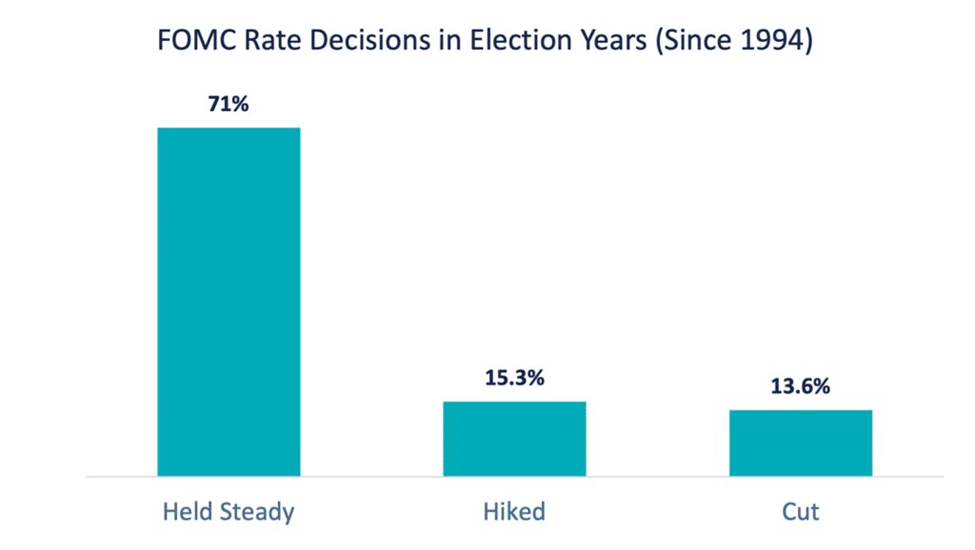

Chart of the Month: Fed Rate Cuts in Election Years

Historically, the Fed has mostly held rates steady during election years, with notable exceptions in 2008 during the Global Financial Crisis and in 2020 during the COVID-19 pandemic.

Source: Barron’s

Equity Markets in March

– S&P 500: Up 3.10%

– Dow Jones Industrial Average: Rose 2.08%

– S&P MidCap 400: Gained 5.39%

– S&P SmallCap 600: Up 3.03%

Source: S&P Global. All performance as of March 31, 2023

All eleven sectors of the S&P 500 gained in March. Energy led with a 10.43% increase, while Consumer Discretionary, last month’s leader, barely stayed positive at 0.01%. The index hit eight new closing highs in March, achieving 22 year-to-date.

Bond Markets

– 10-year U.S. Treasury: Yield decreased to 4.21% from 4.26% in February.

– 30-year U.S. Treasury: Yield fell to 4.35% from 4.39%.

– Bloomberg U.S. Aggregate Bond Index: Returned 0.92%.

– Bloomberg Municipal Bond Index: Was flat at 0.0%.

The Smart Investor

With the first quarter behind us, here are key focuses for investors:

– Portfolio Rebalancing: Strong equity market performance may have altered your risk profile. Adjust your portfolio to avoid excessive risk.

– Managing High-Interest Debt: With interest rates likely to remain high, prioritize paying off high-interest debt.

– 529 Plan Review: As the school year ends, review education savings plans. Adjust risk parameters as needed, especially with the SECURE 2.0 Act changes.

– Financial Housekeeping: Keeping your finances aligned with your goals ensures flexibility throughout your financial journey. If you have questions, we’re here to help.

Keeping your finances on track with your goals is something you don’t want to think about all the time, but focusing on it can ensure you create the flexibility you want throughout your financial journey.

Disclaimer

The information provided in this monthly blog post about the stock and bond market is intended for general informational purposes only and should not be construed as personalized financial, investment, tax, or legal advice. The content reflects the author’s opinions and analyses based on current market conditions and historical data, which are subject to change without notice.

Investing in the stock and bond markets involves significant risk, including the potential loss of principal. The strategies and viewpoints discussed in this blog post may not be suitable for all investors and should not be relied upon as the sole basis for making any investment decisions. Past performance is not indicative of future results. We strongly recommend that you consult with a qualified financial advisor, tax professional, or legal expert before making any financial decisions or implementing any financial strategies. Any decisions made based on the information in this post are solely at your own risk.