February Recap and March Outlook

The narrative the recent economic data tells may vary depending on your focus. However, one perspective has been strikingly consistent this year: the market does not seem to care about any of it.

In February, the S&P 500 broke through the 5,000 ceiling for the first time, achieving eight new closing highs during the month. While a robust equity market is encouraging, its broader economic implications remain uncertain. High-interest rates and persistent, albeit declining, inflation have driven up the cost of living. Prospective homebuyers face challenges from low housing inventory and high mortgage costs. Will 2024 see the economy find equilibrium, or will the Federal Reserve’s cautious stance on inflation control, coupled with high rates, continue to impede growth?

The Fed’s primary focus remains reducing inflation, a task requiring a comprehensive analysis of economic data. The decision to cut rates carries significant weight, as it could reignite economic activity and potentially spur inflation again. Fed Chairman Powell has maintained a cautious approach, emphasizing readiness to return to a tightening stance if necessary. Markets have shifted their expectations for a rate cut from March to June, reflecting this cautious optimism.

In his Congressional testimony, Powell warned that “reducing policy restraint too soon or too much could result in a reversal of progress…and require tighter policy to get inflation back to 2%.” Yet, he also noted that risks are now more balanced, indicating potential rate cuts this year.

Economic Data Highlights:

– Consumer Price Index (CPI): CPI remained over 3%, with a 3.1% increase for the 12 months through January. Core CPI, excluding food and energy, rose 3.9%, unchanged from December.

– Consumer Spending: January retail sales fell 0.8% from December, as reported by the Commerce Department.

– Business Activity: The S&P 500 Global Flash US Composite PMI dropped from 52.0 to 51.4 in mid-February, indicating marginal expansion.

– Housing Market: Mortgage rates dipped below 7% after spiking in February, but home prices increased by 5% year-over-year, according to Redfin.

What Does the Data Add Up To?

Businesses are increasingly optimistic, markets anticipate rate cuts, and the earnings season has shown improvement. Although inflation remains a challenge, reduced consumer spending could drive it down further. The housing market remains problematic; lower rates might make homes more expensive as demand surges.

Vice-chair Philip Jefferson highlighted three key risks in his first speech:

1. Consumer Resilience: If consumer spending remains strong, inflation control could stall.

2. Employment Balance: The Fed aims to reduce employment to manage inflation but is wary of excessive job losses.

3. Geopolitical Risks: These continue to pose unpredictable threats.

The Fed’s meeting on March 20th will be crucial for providing further guidance. Beyond the initial rate cut decision, the pace of subsequent cuts and whether the Fed will meet its target rate for the year remain significant questions.

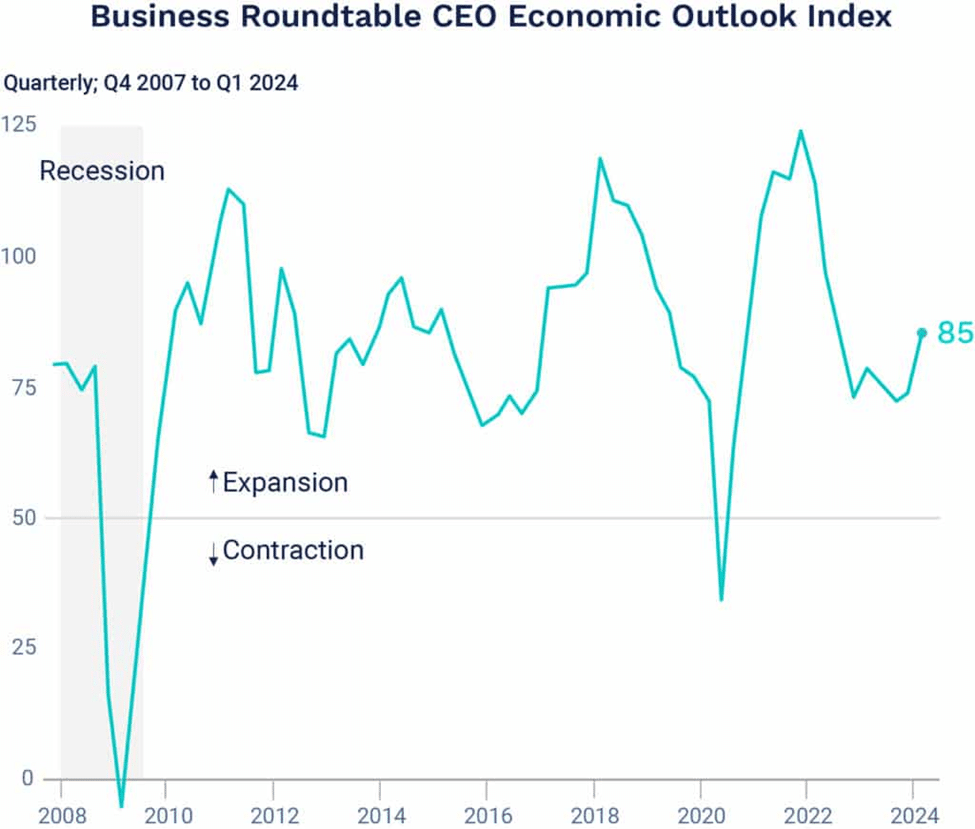

Chart of the Month: Business Optimism

CEOs are showing confidence in the economy, anticipating stronger sales and increased capital investments. The CEO Economic Outlook Index rose in the first quarter, surpassing the long-term average by two points.

Source: Business Roundtable, Axios Visuals

Equity Markets in February

– S&P 500: Up 5.17%

– Dow Jones Industrial Average: Rose 2.22%

– S&P MidCap 400: Gained 5.80%

– S&P SmallCap 600: Up 3.15%

Source: S&P Global. All performance as of February 29, 2024

All eleven sectors posted gains, with Consumer Discretionary leading at 8.60% and Utilities at the bottom with a modest 0.53% gain. The S&P 500 recorded gains on 13 of 20 trading days in February. The Magnificent 7 continued to dominate, with a deal on a stop-gap budget providing some relief for March’s potential performance.

Bond Markets

– 10-year U.S. Treasury: Yield increased to 4.26% from 3.93% in the previous month.

– 30-year U.S. Treasury: Yield rose to 4.39% from 4.17%.

– Bloomberg U.S. Aggregate Bond Index: Returned -1.41%.

– Bloomberg Municipal Bond Index: Posted a positive return of 0.13%.

The Smart Investor

As winter fades and spring approaches, it’s an ideal time for financial housekeeping. As you start to think about Spring cleaning, have you given any thought to your financial housekeeping?

– Are you missing anything? This phase of the cycle is still in flux, but rates are likely to be higher, and volatility may be spiky. Is your portfolio diversified enough to cushion any shocks?

– Tax season is upon us. As you go through the process, have you identified steps you could take to lower your taxes next year? Don’t put those off. Maximizing a 401(k) is easier if you start early, and adding every month, instead of all at once, can lower your risk.

– There’s still time to lock in high CD rates. Have you thought about putting your cash to work?

– Is your emergency fund keeping up with your lifestyle and your income? Time to tune it up

Keeping your finances aligned with your goals ensures flexibility throughout your financial journey.

Disclaimer

The information provided in this monthly blog post about the stock and bond market is intended for general informational purposes only and should not be construed as personalized financial, investment, tax, or legal advice. The content reflects the author’s opinions and analyses based on current market conditions and historical data, which are subject to change without notice.

Investing in the stock and bond markets involves significant risk, including the potential loss of principal. The strategies and viewpoints discussed in this blog post may not be suitable for all investors and should not be relied upon as the sole basis for making any investment decisions. Past performance is not indicative of future results. We strongly recommend that you consult with a qualified financial advisor, tax professional, or legal expert before making any financial decisions or implementing any financial strategies. Any decisions made based on the information in this post are solely at your own risk.