It’s one of the most well-known investing clichés — “Sell in May and go away.”

Catchy? Sure.

Useful? Not so much.

This old adage suggests that investors should cash out of the stock market in May and sit on the sidelines until November, avoiding what’s often perceived as a weak stretch for stocks. But when we actually look at the data, this strategy hasn’t just underperformed — it’s significantly trailed a simple buy-and-hold approach.

The Numbers Tell the Story

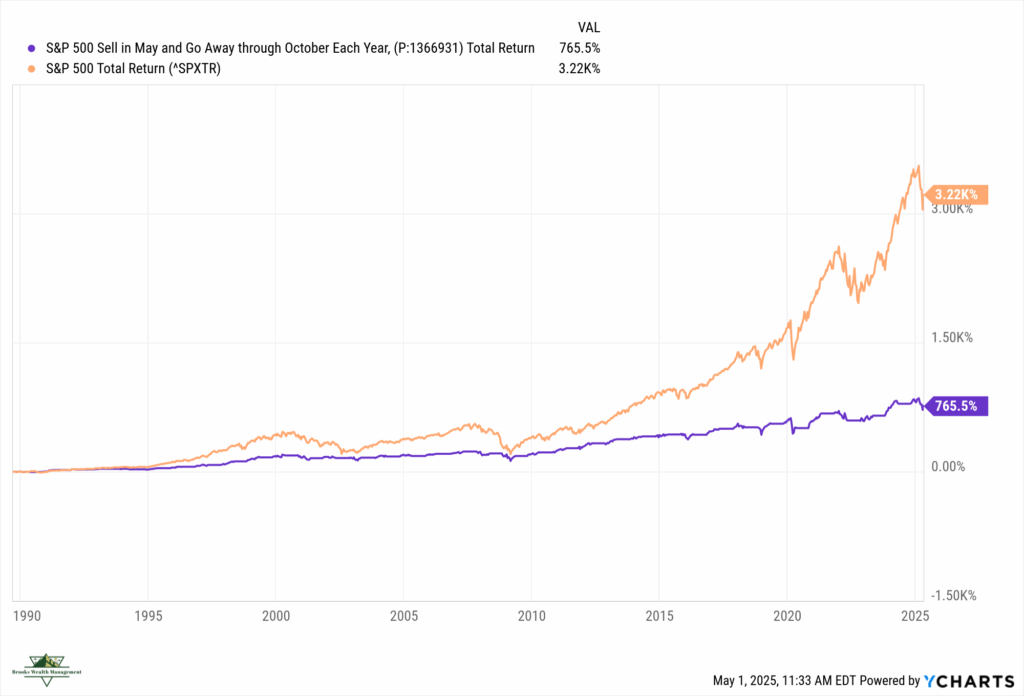

If you had followed the “Sell in May” strategy every year since 1990 — investing in the S&P 500 from November through April and moving to cash from May through October — your total return over that period would have been approximately 765%.

That may sound decent… Until you compare it to what would’ve happened if you had just stayed fully invested.

Over the same time period, the S&P 500 Total Return Index delivered a 3,220% return.

That’s not a typo. That’s the cost of trying to time the market based on a rhyme.

Why Timing the Market Rarely Works

The biggest issue with these types of calendar-based strategies is that they force you to make decisions based on historical patterns rather than actual fundamentals, financial planning, or your unique goals.

Even missing just a few of the market’s best days — which often occur during times of uncertainty — can seriously reduce your long-term returns.

The Real Strategy That Works

Rather than jumping in and out of the market based on seasonal trends or headlines, long-term success tends to come from:

- Having a clear, personalized investment plan

- Staying invested through ups and downs

- Avoiding emotional, reactive decisions

- Rebalancing and adjusting based on your goals — not short-term noise