Inflation is a silent killer. Over time, it chips away at the purchasing power of our savings, turning what was once a fortune into something far less substantial. A hundred years ago, retiring with $1 million put you in the 1% of the 1% – more than enough to secure a lifetime of comfort and stability.

Today, though, we have to ask an uncomfortable question: Is $1 million even enough to retire on anymore? If you prefer to watch or listen, check out the video above. Prefer to read? Keep scrolling!

To put this in perspective, let’s look back to the 1940s, when Phoenix Mutual ran ads promoting retirement with $300 a month. For the average retiree, that monthly income was a promising goal. What’s even more comical? They were retiring in Southern California in this ad! While the ad may seem laughable today, it highlights just how dramatically our financial landscape has shifted over time.

So, is $1 million still enough? Let’s find out.

Meet the Dunphy’s: A Case Study on Modern Retirement

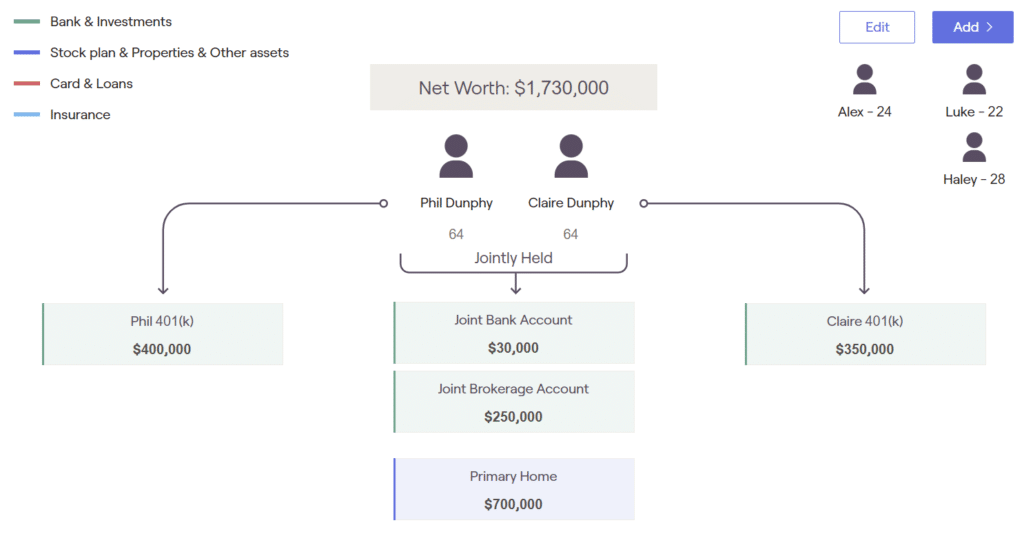

To help explore whether $1 million of investment assets is still enough to retire comfortably, let’s meet our case study clients, Phil and Claire Dunphy. Yes, that’s right—these are the parents from Modern Family! This case study is for illustration purposes only and is not based on real clients, but it gives us a fun scenario to analyze.

Phil and Claire’s Profile:

Phil and Claire are both 64 years old and planning to retire in December 2024. They have three grown children—Haley, Alex, and Luke—who are all financially independent. Their current net worth stands at $1,730,000, with the following assets:

- Investment Accounts: Phil’s 401(k) is $400,000, and Claire’s is $350,000, both pre-tax. They also have a joint brokerage account valued at $250,000, with a cost basis of $150,000.

- Primary Residence: Fully paid off and valued at $700,000.

- Bank Account: $30,000.

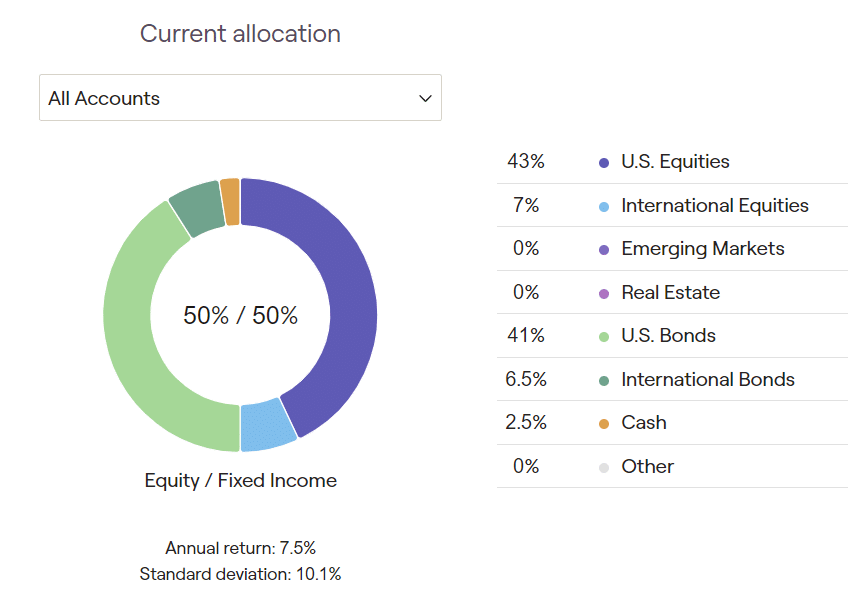

Investment Allocation:

Phil and Claire’s investments are allocated with a mix of stocks, bonds, and cash. Their portfolio is currently split roughly 50% in stocks and 50% in bonds, with a small portion of the portfolio in cash.

Retirement Goals and Lifestyle:

The Dunphy’s envision a retirement lifestyle with a monthly living expense of $7,500 (before taxes and excluding some additional specific goals below):

- Annual Vacation: $15,000 per year.

- New Car: Every six years, with a budget of $30,000.

- Long-Term Care (LTC): Planned costs for the final two years of their financial plan (ages 94 and 95), based on national LTC averages.

Social Security Plans:

Phil’s Social Security benefit at full retirement age (67) would be $3,200 per month, but he plans to file at retirement in December 2024, taking a reduced benefit. Claire’s full retirement benefit is $3,000 per month, but she also intends to start her benefit at the end of 2024.

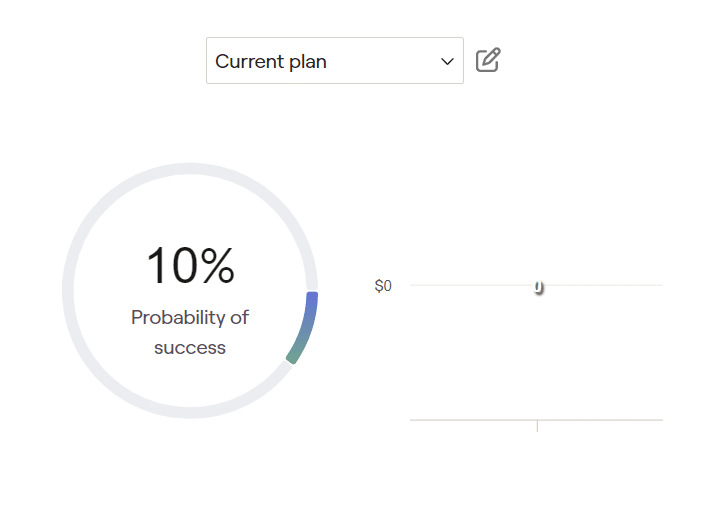

Initial Monte Carlo Simulation

To see if Phil and Claire are ready for retirement, we used something called a Monte Carlo simulation. This is a tool that helps predict what might happen to their portfolio in the future by testing it against 1,000 different market scenarios. For this first test, we looked at their situation as it is now, without making any changes.

The results reveal a 10% probability of success. This means that only ~100 out of the 1,000 simulated scenarios allowed Phil and Claire’s investment assets to last through the end of their plan – which is not great.

Recommendations: Improving Retirement Success without Lifestyle Changes

With a 10% success rate in their current financial plan, Phil and Claire need adjustments to their strategy to improve the chances of meeting their goals. The following recommendations involve adjustments that require no lifestyle changes. These include adjusting their asset allocation and allocation glide path, reconsidering their Social Security filing dates, and implementing tax-efficient strategies. Here’s a closer look at each:

Asset Allocation

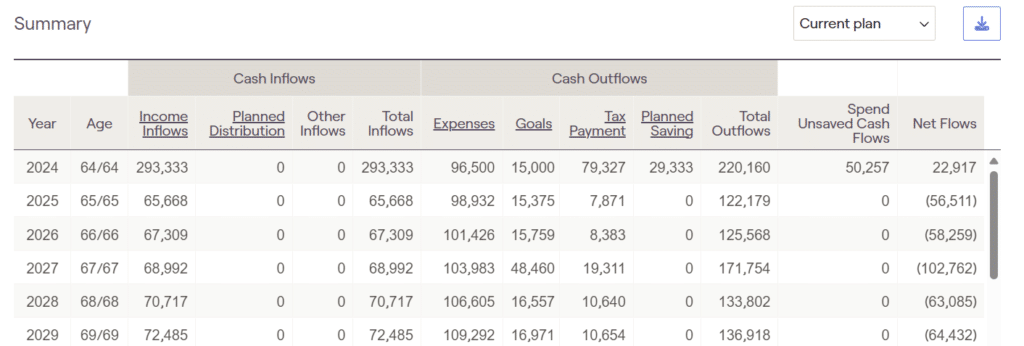

When designing a retirement portfolio, it’s essential to ensure there’s enough stability in assets to cover expenses while allowing for growth. To evaluate Phil and Claire’s current asset allocation, we first examined their cash flow ledger (which you can find below). This shows that in retirement, they’ll need approximately $60,000 from their portfolio each year. With a 50% allocation to bonds, they currently hold about eight years’ worth of expenses in more stable, lower-risk assets.

Bonds play an absolutely pivotal role in a retirement plan, but it’s easy to overdo it. While they provide stability and protection during market downturns, having too much in bonds can limit the opportunity for growth.

We don’t know Phil and Claire personally and haven’t conducted a full risk assessment, so their tolerance for risk may lean conservative. They may simply want to avoid dealing with the stress of another stock market downturn—because there will be one. It’s not a matter of if but when. The key is being prepared for it without sacrificing unnecessary growth.

For example, their current allocation of eight years’ worth of expenses in bonds may be too cautious. Historical data shows that “bear markets” (20% drawdown from previous high) for the S&P 500 typically last about one year on average. With eight years of expenses in bonds, Phil and Claire risk missing out on the growth potential of the stock market during “bull markets” (20% increase from previous low).

I’ve worked with clients who wanted a 100% bond portfolio, and while it’s possible to structure a plan around this preference, it comes with trade-offs—primarily the struggle to keep up with inflation. While past performance doesn’t guarantee future results, studying market history provides valuable insights into planning for what’s ahead.

Recommended Adjustment: 5 Years of Expenses in Bonds

After evaluating Phil and Claire’s current bond allocation, I would likely recommend adjusting their strategy to hold approximately five years’ worth of expenses in bonds. With an annual portfolio need of around $60,000, this would mean holding $300,000 in bonds.

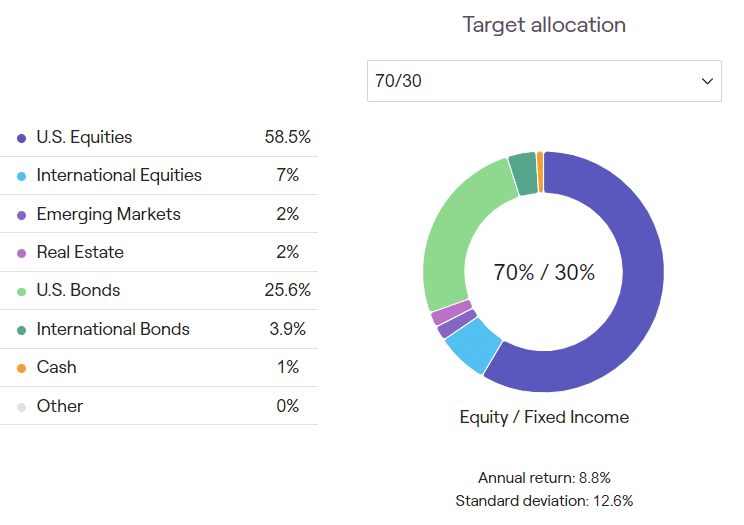

To implement this adjustment, I would recommend moving to a 70% stock and 30% bond allocation. This would provide the necessary $300,000 in bonds while allowing the remaining portfolio to benefit from the growth potential of stocks. A 70/30 mix would position Phil and Claire’s portfolio to better keep up with inflation and support their long-term retirement goals.

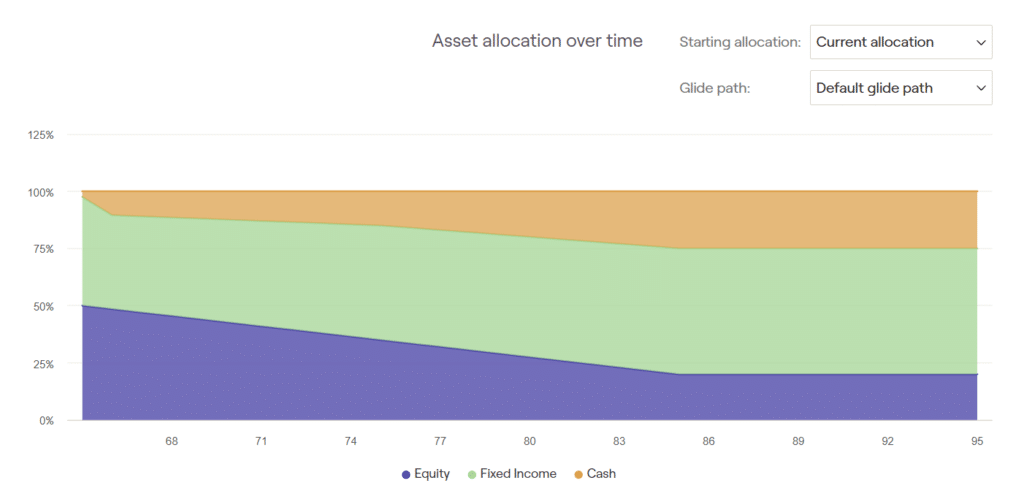

Allocation Glide Path: Assessing the Suitability of a Default Glide Path

Phil and Claire’s current investment trajectory follows a “default glide path”, similar to those used by major target-date funds. This means that as they approach retirement and move into their retirement years, their portfolio will gradually shift to a more conservative allocation. For many, this default glide path provides a stable approach. However, for retirees like Phil and Claire who plan to use their portfolio for a long retirement, a highly conservative allocation may limit their growth potential too much, making it harder to keep up with inflation and maintain purchasing power over time.

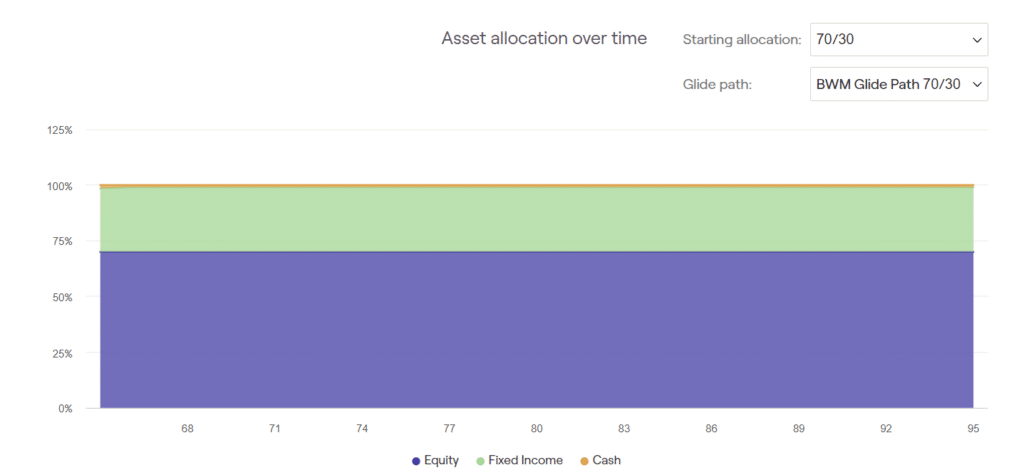

Customizing the Glide Path for Phil and Claire’s Needs

Given Phil and Claire’s retirement goals, a more gradual shift in their asset allocation, or even maintaining their current allocation throughout retirement, could provide the best balance between stability and growth. This approach is often referred to as a “flat glide path,” where the asset allocation remains consistent throughout retirement, instead of gradually becoming more conservative as they age.

This customization would allow them to better meet their long-term goals, especially if they are comfortable with market volatility and believe their portfolio has enough safety in the bond portion to weather the inevitable market fluctuations.

For Target-Date Fund Investors

For those in target-date funds, it’s important to remember that the fund’s underlying investments will shift as you approach and enter retirement. Without active monitoring, the allocation might become too conservative to meet your long-term goals. Phil and Claire’s situation is a reminder that while target-date funds can simplify investing, they aren’t one-size-fits-all.

Social Security Filing Date: Maximizing Benefits

Phil and Claire plan to start their Social Security benefits at retirement in December 2024, rather than waiting until their full retirement age (67). This decision will result in a reduced monthly benefit. Phil’s full retirement benefit is $3,200 per month, and Claire’s is $3,000 per month. By filing early, they will face a reduction in their monthly payments.

Recommendation: Potentially Delaying Social Security for Higher Long-Term Benefits

While it may seem tempting for Phil and Claire to start collecting Social Security early for extra cash flow, delaying their benefits until full retirement age (or even until age 70) could result in a much higher monthly payment over time. The longer they wait, the bigger their Social Security checks will be, which can help cover rising expenses as they age, and they’ll rely less on their investment portfolio.

Phil and Claire have planned their retirement to last until age 95 – since they have longevity in their family and are both currently healthy. Life expectancy and health play a big role in deciding the best time to start collecting Social Security.

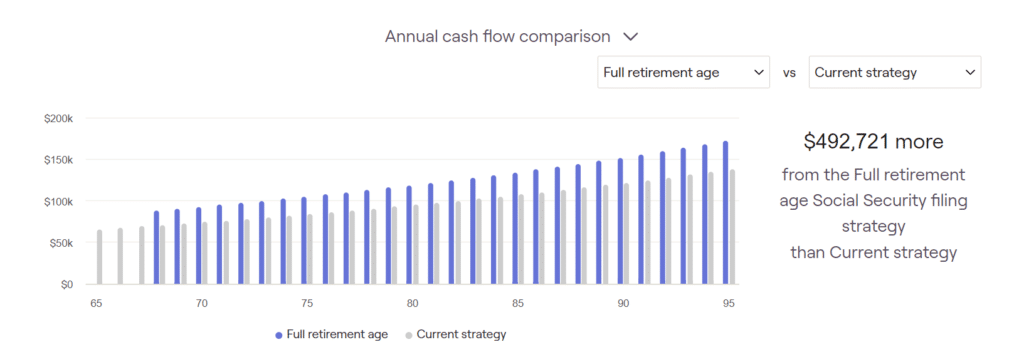

The chart below compares how much they will receive in total if they start Social Security at full retirement age (67) versus starting at retirement (64). By waiting until age 67, they could receive nearly $500,000 more of benefits by the time they turn 95.

However, delaying Social Security means they will need to pull more money from their investment portfolio in the meantime. If their investments do well during that time, this might not be a big issue, but if the market doesn’t perform, they could end up withdrawing more than planned from their portfolio. This is a risk, but the larger Social Security checks later could make it worth it in the end.

Tax Planning Recommendation: Asset Location Strategy

When managing retirement assets, an effective tax strategy is deciding which types of investments to place in which accounts—this is called asset location. The goal is to minimize the tax impact over the long term by placing your most tax-efficient investments in tax-deferred accounts and your less tax-efficient ones in accounts that grow tax-free, such as Roth IRAs.

Phil and Claire’s allocation is a 70% stock and 30% bond split, but how they allocate these assets among their taxable, tax-deferred, and tax-free accounts can have a significant impact on their long-term tax strategy.

Stocks in Roth Accounts: Tax-Free Growth

Stocks generally offer higher long-term growth potential compared to bonds. While capital gains from stock sales in taxable accounts are taxed at a preferential rate, those taxes can add up over time. A Roth IRA, however, offers tax-free growth and withdrawals, meaning Phil and Claire can benefit from their stocks’ growth without worrying about future taxes on capital gains or dividends. For that reason, having your Roth accounts be 100% stock could be the most advantageous thing to do.

Bonds in Tax-Deferred Accounts: Lower Taxable Income

Bonds, on the other hand, generate income that is taxed at ordinary income rates. When held in taxable accounts, this income can be heavily taxed. To avoid this, Phil and Claire can place most of their bonds in tax-deferred accounts like a 401(k) or Rollover IRA. This allows them to defer taxes on bond income until they withdraw the funds, and it protects the bond income from annual taxes, giving it more time to grow.

Brokerage Accounts: Flexible but Taxed

Taxable brokerage accounts work best for assets that don’t generate significant taxable income, like tax-efficient index funds or stocks with long-term growth potential. While capital gains in these accounts are taxed when assets are sold, the tax rates tend to be lower than ordinary income rates. Dividends may be taxed at either ordinary income or qualified dividend rates.

Tax-Efficient Strategy

By placing stocks in the Roth account, bonds in tax-deferred accounts, and using taxable brokerage accounts for more tax-efficient assets, Phil and Claire can keep their asset allocation intact—70% stocks, 30% bonds—while maximizing tax efficiency. This strategy helps reduce their tax burden both during their working years and in retirement.

If you’re wondering why we’re discussing Roth accounts even though the Dunphy’s don’t have one yet, stay tuned.

Tax Planning Recommendation: Withdrawal Strategy

An important aspect of retirement planning is which account you pull from first. A tax-efficient withdrawal strategy can help minimize your tax liability over time, ensuring that Phil and Claire can enjoy their retirement income without paying unnecessary taxes. Here’s a recommended sequence for withdrawing funds for Phil and Claire:

1. First: Withdraw from the Brokerage Account

The brokerage account can be the best place to start when it comes to withdrawals because it is typically taxed at lower rates compared to other accounts.

By depleting the brokerage account first, Phil and Claire can minimize the impact on their tax-deferred and tax-free accounts, preserving the growth potential of these accounts for later.

2. Second: Withdraw from Tax-Deferred Accounts (e.g., 401(k), IRA)

Once the brokerage account is depleted, the next step is to draw from tax-deferred accounts like 401(k)s or Traditional IRAs. While withdrawals from these accounts are taxed as ordinary income, they are still a good source of funds for the following reasons:

- Tax Deferral: Since the tax on these funds is deferred until retirement, this strategy allows Phil and Claire to take advantage of their lower tax bracket in retirement. If their income needs are not significantly high, they may end up paying a lower tax rate on these withdrawals compared to when they were working.

- RMDs: Keep in mind that starting at age 73, Phil and Claire will be required to take required minimum distributions (RMDs) from these accounts. To avoid having to take large, mandatory withdrawals later on, it makes sense to draw from these accounts sooner rather than later, keeping their future RMDs more manageable.

3. Last: Withdraw from Tax-Free Accounts (e.g., Roth IRA)

Finally, once the taxable and tax-deferred accounts have been used, the last resource for withdrawals should be their tax-free accounts, such as Roth IRAs. Roth IRAs offer a unique advantage because:

- No Taxes on Withdrawals: Roth IRAs allow tax-free withdrawals of both contributions and earnings, as long as the account has been open for at least five years and you are age 59 1/2 or older. By leaving the Roth IRA intact for as long as possible, Phil and Claire can maximize the benefit of having tax-free income in their later years.

- No RMDs: Roth IRAs do not have required minimum distributions (RMDs) during the account holder’s lifetime, so Phil and Claire will not be forced to take withdrawals unless they choose to. This makes the Roth a great source of funds to tap last, allowing the account to continue growing tax-free for as long as possible.

Tax Planning Recommendation: Roth Conversions

As Phil and Claire approach retirement, one effective strategy to minimize their tax liability over the long term is to consider Roth conversions. Since they expect their income to be lower in retirement than it is while they are still working, converting some of their tax-deferred assets (such as their 401(k) and traditional IRAs) into Roth IRAs could offer significant benefits.

Why Roth Conversions?

Roth IRAs offer a number of advantages, particularly for those currently in lower tax brackets. The following benefits are:

- Tax-Free Growth: Roth accounts allow for tax-free growth on earnings, which means that any money converted into a Roth account now can grow without being subject to taxes later.

- Lower Future Required Minimum Distributions (RMDs): Once Phil and Claire reach the age of 73, they will be required to take minimum distributions from their tax-deferred accounts (401(k)s, IRAs). These RMDs are based on the value of the accounts at that time and are taxed as ordinary income. By converting funds to a Roth IRA now, they reduce the balance in their tax-deferred accounts, which in turn lowers the amount of RMDs they will have to take later on. This helps to avoid large taxable withdrawals in future years.

- Lower Tax Rates Now: Since Phil and Claire are expected to have lower income in retirement, they will likely be in a lower tax bracket than during their working years. This creates an opportunity for them to convert some of their tax-deferred funds to a Roth IRA at a relatively low tax rate. Additionally, current tax rates are favorable, especially considering the growing U.S. debt and deficit. It’s likely that tax rates will increase in the future, so converting now could help them save on taxes in the long run.

Recommended Conversion Strategy

- Convert to the 10% Tax Bracket: By converting funds up to the 10% tax bracket, Phil and Claire can minimize the tax impact in the short term while setting themselves up for a more tax-efficient retirement. These conversions will be taxed at a low rate, and future withdrawals from the Roth IRA will be tax-free.

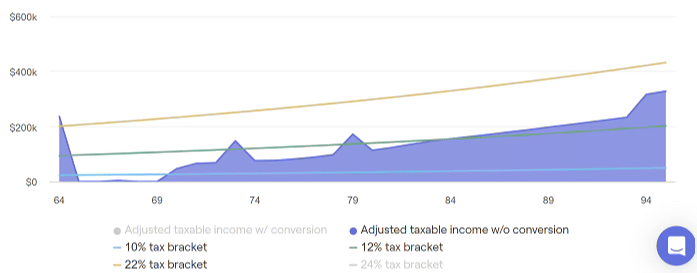

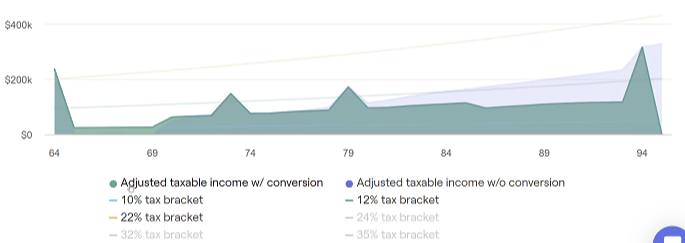

- Yearly Conversions: Since Phil and Claire plan to retire at the end of 2024, they can begin Roth conversions starting in 2025. Over the course of the next few years (ages 65–69), they can convert a portion of their 401(k) and IRA assets to Roth IRAs each year. The images below compare the before and after expected taxes of their current tax situation vs with the Roth conversions to 10% tax bracket.

- Long-Term Benefit: The ultimate benefit of this strategy is the reduction of taxable RMDs when they reach age 73. By converting assets to a Roth IRA during their lower-income years, they will have fewer taxable assets remaining in their 401(k) or traditional IRAs, leading to lower required distributions and a reduced tax burden in the future.

- When to Do Roth Conversions: The best time to do a Roth conversion is typically when there’s a pullback in the portfolio, as this allows you to convert more assets at a lower value. However, it’s not always clear what your full tax situation will be if a market pullback happens early in the year. To manage this uncertainty, I recommend a strategy where you convert half of the expected amount if the S&P 500 drops by 10% at any point during the year. Then, you can convert the other half if the S&P 500 falls by another 10% (total 20% pullback). If the S&P 500 does not pullback then I recommend executing the conversions at the end of the tax year (December). This approach helps maximize the conversion opportunity while managing risk.

No Conversion Expected Tax Situation

Roth Conversion Expected Tax Situation

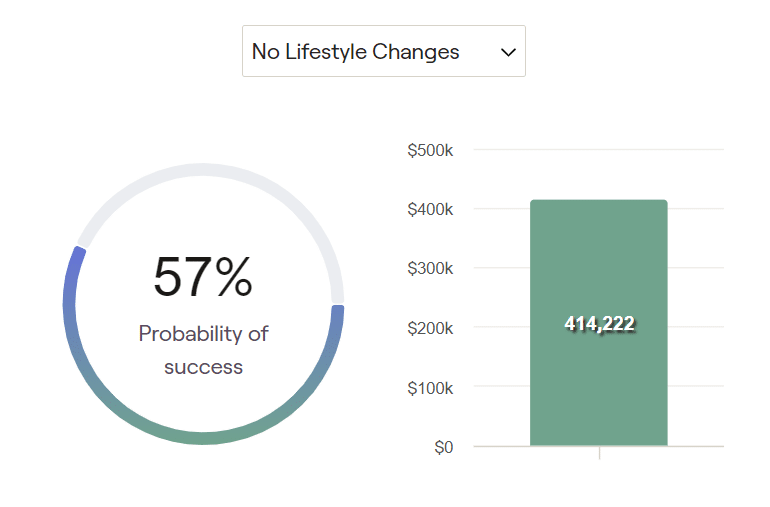

Monte Carlo Simulation: Impact of Non-Lifestyle Change Recommendations

By implementing the six non-lifestyle change recommendations, we’ve significantly improved the financial outlook for Phil and Claire. Initially, their probability of success in their financial plan was 10%, meaning that in 100 out of 1,000 Monte Carlo simulations, their plan would end successfully without depleting their investment assets.

However, after applying the following strategies:

- Asset Allocation

- Glide Path

- Social Security Filing

- Asset Location

- Withdrawal Strategy

- Roth Conversions

The probability of success increases to 57%. This is a substantial improvement, as we have shifted their plan from a path toward potential disaster to one that has a chance.

While a 57% probability of success still isn’t ideal, it represents a more stable trajectory than before. This outcome highlights the importance of planning, even without altering the lifestyle or goals.

Lifestyle Changes: Improving Phil and Claire’s Financial Outlook

In addition to the non-lifestyle change recommendations, there are several lifestyle adjustments that Phil and Claire could consider making to further improve their financial situation. While lifestyle changes are not easy to implement, they provide a more direct way to enhance the probability of a successful retirement.

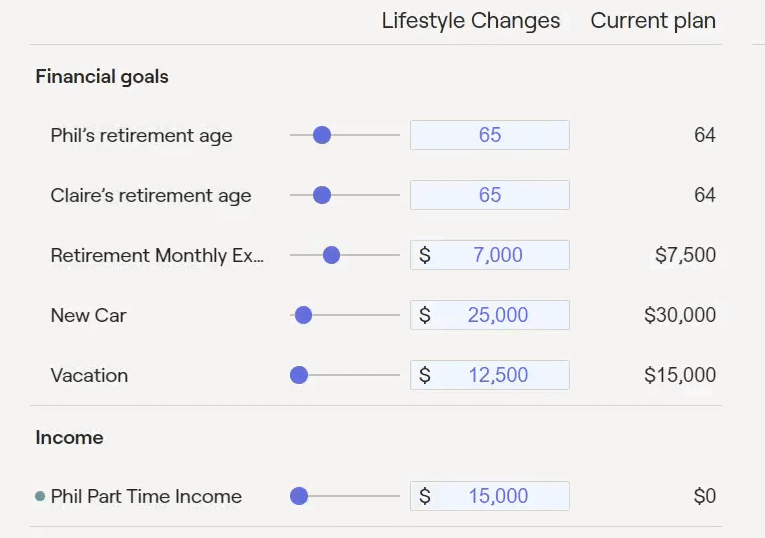

Here are the proposed lifestyle changes:

- Retiring at 65 instead of 64

- Reducing Monthly Living Expenses

- Reducing Car Purchase Budget

- Vacation Budget Reduction

- Phil Working Part-Time Until Age 75

By incorporating these adjustments, we see that the probability of success in the Monte Carlo simulation increase from 10% to 60%. While these changes are meaningful and certainly improve the situation, 60% is still not a great probability of success.

The real power comes when we combine lifestyle changes with your non-lifestyle changes to have a complete comprehensive financial plan.

Combining All Recommendations: Creating a Sustainable Future

By integrating both the non-lifestyle change recommendations and the lifestyle changes, we significantly improve Phil and Claire’s retirement plan. Here’s a recap of the key strategies implemented:

Non-Lifestyle Change Recommendations:

- Asset Allocation

- Glide Path

- Social Security Filing

- Asset Location

- Withdrawal Strategy

- Roth Conversions

Lifestyle Changes:

- Retiring at 65 instead of 64

- Reducing Monthly Living Expenses

- Reducing Car Purchase Budget

- Vacation Budget Reduction

- Phil Working Part-Time Until Age 75

The Results:

By incorporating these strategies, the Monte Carlo simulation shows that their probability of success increases to 85% — a significant improvement from the original 10%. In addition to this improved success rate, the plan leaves expected approximately $3 million in portfolio assets to pass on to their children.

Refining the Plan: Prioritizing What’s Most Important

Now that we’ve established a successful retirement plan with an 85% probability of success, we can revisit some of the assumptions and make adjustments to align the plan more closely with Phil and Claire’s priorities. Retirement planning isn’t static — it’s about finding a balance between financial stability and enjoying life. Let’s explore what happens when we pull some key levers based on their preferences.

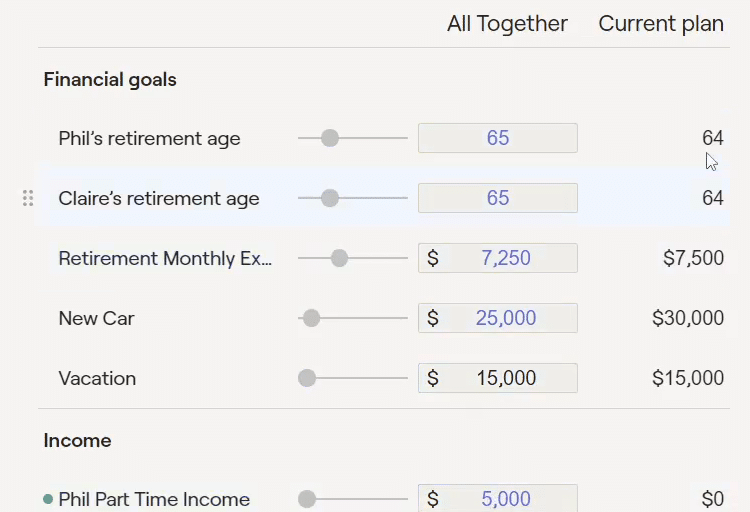

Key Adjustments:

- Retiring at 65: Since retiring at 65 is both doable and beneficial, we will keep this as the retirement age.

- Increasing Monthly Budget: Raising the monthly retirement living expense to $7,250.

- Restoring Vacation Budget: Returning to $15,000 annually for travel is a key priority for Phil and Claire.

- Reducing Part-Time Income: Scaling back Phil’s part-time work to $5,000 annually.

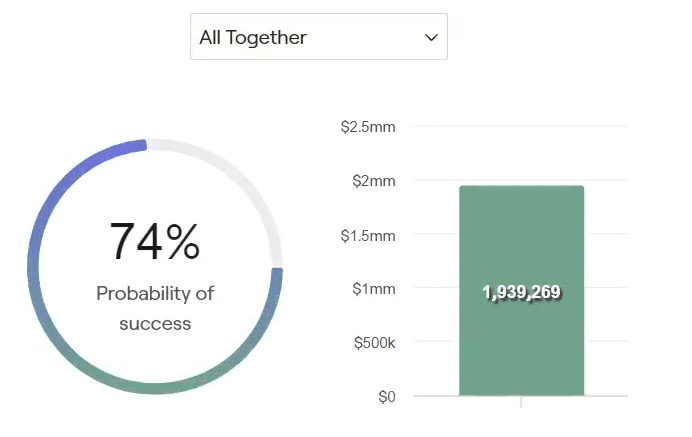

Monte Carlo Results:

After running these adjustments through the updated Monte Carlo simulation, the probability of success is 74%, and their portfolio is projected to leave a legacy of just under $2.0 million for the next generation.

Balancing Financial Success with Personal Goals:

This refined plan demonstrates the flexibility of retirement planning. By prioritizing what is most important — whether it’s travel, lifestyle, or leisure — Phil and Claire can confidently move forward with a retirement plan they are excited to live.

Bonus Insight: Why a 74% Probability of Success Can Be a Great Outcome

When planning for retirement, it’s important to understand that a 74% probability of success doesn’t mean a 26% chance of running out of money. Instead, it reflects how well the financial plan holds up under a thousand hypothetical scenarios, even in unfavorable market conditions. In practice, life unfolds dynamically, and retirees naturally adjust their spending and strategies over time. Let’s explore one key factor that can further improve Phil and Claire’s outlook:

The Retirement Spending Smile

Research shows that retirement spending typically follows a “smile” pattern:

- Early Years: Higher spending on travel, hobbies, and lifestyle goals.

- Middle Years: Decreased spending as retirees settle into routines and reduce discretionary costs.

- Later Years: Spending increases again due to healthcare and long-term care expenses.

By incorporating national averages for the retirement spending smile into the financial plan, we reflect a realistic pattern of how expenses change over time.

Updated Results with the Spending Smile

After implementing the spending smile into Phil and Claire’s financial plan the probability of success Increased from 74% to 89%.

Bonus Insight: Factoring in Non-Portfolio Assets

Monte Carlo simulations are a powerful tool for evaluating financial plans, but they focus exclusively on portfolio assets. This means they often exclude the value of other significant assets—such as a fully paid-off home. For Phil and Claire, their $700,000 home represents a meaningful part of their overall wealth, which can be leveraged if needed.

Relocation Scenario

To explore this, I added a scenario where, in 2044 (at age 84), Phil and Claire decide to downsize:

- Sell Current Home: The value of their current home has appreciated over the years, reflecting inflation.

- Purchase New Home: They purchase a smaller home worth $450,000 in today’s dollars (adjusted for inflation in 2044).

The net proceeds from this transaction (after accounting for real estate costs) are added back into their portfolio assets, providing additional financial security in their later years.

Impact on Their Financial Plan

The Monte Carlo probability of success increases from 89% to 95%.

Why This Scenario Matters

By incorporating two natural and practical concepts—the retirement spending smile and the possibility of downsizing their home in later years—we elevated Phil and Claire’s financial plan to a 95% probability of success. These adjustments reflect changes that may happen naturally over time. Knowing that these two items might happen naturally, allows Phil and Claire to be a little bit more aggressive with their retirement planning and further reduce the amount of lifestyle changes that they need to make.

The beauty of a well-designed plan is that it’s dynamic. We can always revisit the planning software to fine-tune assumptions, adjust strategies, and pull the right levers until the balance feels right. Whether it’s maximizing their travel budget, retiring on their preferred timeline, or finding a mix of strategies that give them peace of mind, the ultimate goal is to craft a retirement they are excited about.

Closing Thoughts

Closing Thoughts: Is $1 Million Enough to Retire?

The answer to whether $1 million is enough to retire depends largely on the lifestyle you want to live and the financial decisions you make along the way. For some, $1 million may be more than enough to support their retirement goals, while for others, it may require adjustments to either their lifestyle or their financial strategy. Key factors, like anticipated spending, inflation, and market performance, can all influence the adequacy of a $1 million retirement nest egg. Ultimately, it’s about aligning your retirement plan with your goals, risk tolerance, and expected expenses to ensure long-term financial security.

Our planning software, RightCapital, plays a key role in our process, helping to create dynamic, data-driven plans that take into account your unique financial situation. RightCapital allows us to model different scenarios, project future cash flows, and make informed decisions that align with your long-term objectives.

Let’s work together to create a plan that makes sense for you. If you enjoyed this article, click the link below to get notified when I post the next one.

Disclosure:

The information provided in this article is for educational purposes only and should not be construed as financial advice. The examples and case study presented are hypothetical and intended to illustrate general retirement planning concepts. Individual results may vary based on a variety of factors, including but not limited to income, expenses, taxes, market performance, and personal financial circumstances.

While every effort has been made to ensure the accuracy of the information, it is important to consult with a qualified financial advisor to discuss your specific situation before making any financial decisions. Brooks Wealth Management is a registered investment advisor (RIA) and provides fiduciary financial planning services. The planning software, RightCapital, used in this article is a tool for modeling financial scenarios and is not a substitute for professional advice.

Past performance is not indicative of future results, and all investments carry risk, including the potential loss of principal.