From Pensions to Personal Responsibility: The New Reality of Retirement

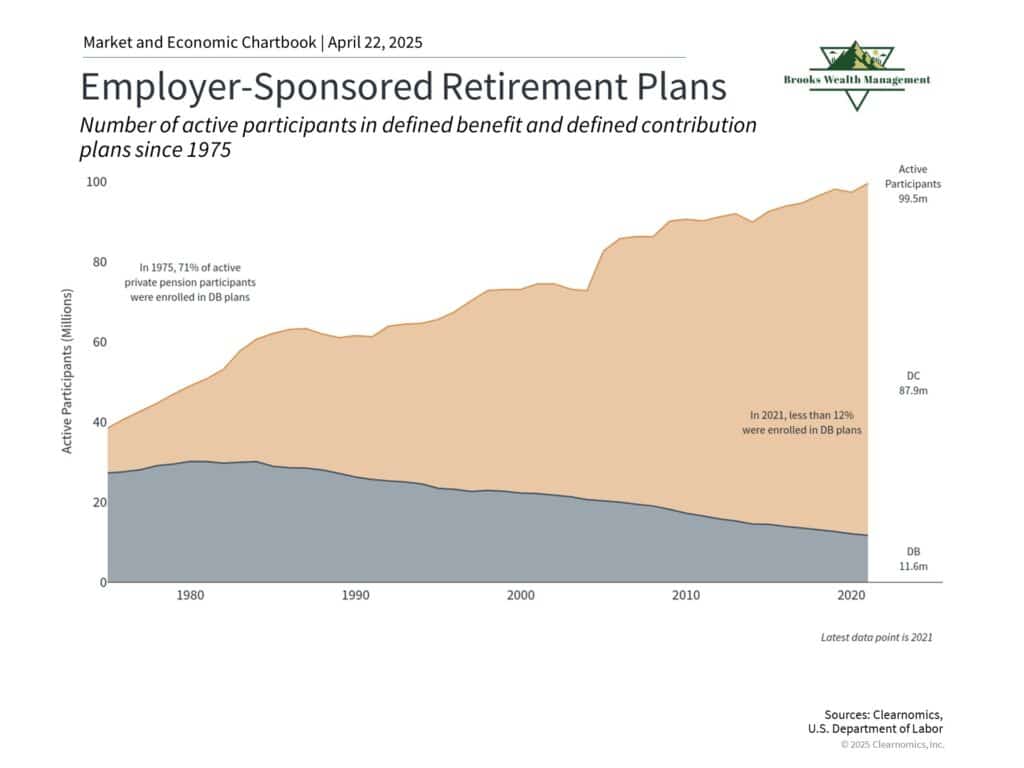

In 1975, more than 70% of private-sector workers were enrolled in defined benefit (DB) pension plans — the kind that […]

From Pensions to Personal Responsibility: The New Reality of Retirement Read More »