December Recap and January Outlook

The debate over when the Federal Reserve will begin cutting key short-term interest rates continued through the end of the previous year and into the start of the new one.

Two months of slowing labor market data, along with changes in the December FOMC statement suggesting the Fed might be done tightening rates, led futures markets to predict nearly an 80% chance of a rate cut in March.

However, December’s non-farm payrolls exceeded expectations, and the Board of Labor’s report showed that wages are once again outpacing inflation.

Will rates still decrease in 2024? The Fed’s dot plot from the last 2023 meeting projected a 2.5% interest rate cut by the end of 2026, with a 75 basis point decrease in 2024, another 100 basis points in 2025, and a final 75 basis points in 2026.

Cutting interest rates while the economy is still growing, even if slowly, would indicate the elusive “soft landing” has been achieved. Inflation has decreased, but Powell remains cautious, describing the “last mile” to reach 2% inflation as more challenging due to normalized supply and the importance of moderating demand.

Key Data Highlights:

– Labor Markets Rebounded: Non-farm payrolls increased by 216,000 in December according to the Bureau of Labor Statistics, exceeding the expected 170,000. Wages also surpassed expectations, rising 4.1% year-over-year.

– Retail Sales Moderated: Mastercard data shows holiday sales between November 1 and December 24 grew at a 3.1% pace, compared to 7.6% last year.

– Shelter Inflation Declined: Housing costs, which have surged since 2020, accounted for nearly 70% of the 4% increase in core CPI in November. However, they have been decreasing since March, reaching an annual rate of 6.5% in November.

Interpreting the Data:

After a nine-week positive streak fueled by expectations of imminent rate cuts, equity markets tempered as the new year began. While a March rate cut may be unlikely, further cuts later in the year remain possible.

The Fed’s priority is ensuring inflation continues to fall towards 2%. Powell is concerned about entrenched inflation that resists policy efforts. With declining housing costs and deflationary price trends, consumer inflation expectations are shifting.

The Federal Reserve Bank of New York’s January 8th Survey of Consumer Expectations revealed that inflation expectations for one year ahead dropped to their lowest level since January 2021, with consumers predicting 3% inflation by next January. This shift in consumer expectations is crucial for policy, as inflation can be a self-fulfilling prophecy. If consumers expect rising prices, they spend more now, driving up costs. Conversely, expecting lower inflation can lead to postponed purchases, naturally slowing the economy.

In a best-case scenario for the end of 2024, according to Fed projections, PCE inflation could be 2.4%, interest rates might fall to 4.25%-4.50%, and unemployment could rise slightly above 4%. The economy would slow but still grow, with any recession likely mild.

Wild Cards:

A domestic election year, volatile gas prices due to geopolitical tensions, and the potential for greater economic impact from significant interest rate hikes. The housing market is already feeling these effects, with higher mortgage rates slowing sales.

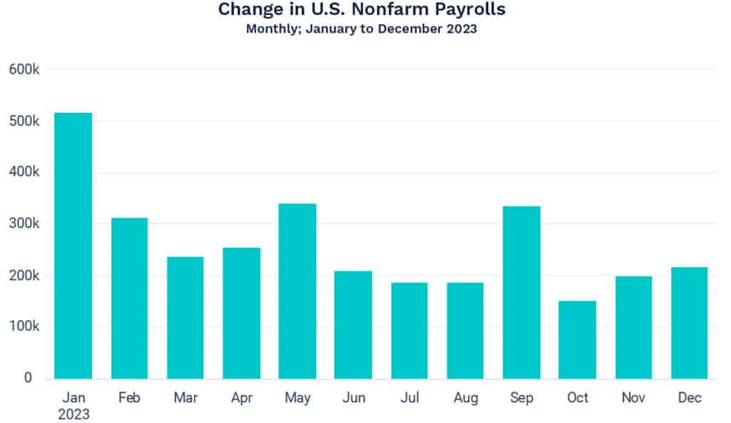

Chart of the Month: Labor Outstrips Expectations

After two months of moderating job gains, December exceeded expectations. However, the impact on investor expectations for a March rate cut may be more significant than the labor market message. The last two months’ numbers were revised down, with an average monthly payroll increase of 225,000 in 2023, compared to 399,000 in 2022.

Source: U.S. Department of Labor data, unrevised. Chart: Axios Visuals

Equity Markets in December:

– S&P 500: Up 4.42% for the month, ending the year up 24.32%.

– Dow Jones Industrial Average: Rose 4.84% for a 2023 return of 13.70%.

– S&P MidCap 400: Increased 8.50% in December and 14.45% in 2023.

– S&P SmallCap 600: Up 12.61% in December, ending the year up 13.89%.

Source: S&P Global. All performance data as of December 31, 2023.

Equity markets finished the year with strong performance, erasing double-digit losses from 2022. Sector-wise, Information Technology led with an 11.18% return over 2022 and 2023, while Energy, despite a 4.80% loss in 2023, had a two-year return of 51.41%. Utilities were the biggest loser, down 11.49% over the combined period.

Bond Markets:

– 10-year U.S. Treasury Yield: Ended December at 3.88%, down from 4.34% in November.

– 30-year U.S. Treasury Yield: Ended December at 4.04%, down from 4.50%.

– Bloomberg U.S. Aggregate Bond Index: Returned 3.83%, with a year-to-date return of 5.15%.

The Smart Investor:

As the new year begins, setting new goals and organizing your financial life are essential. Here are some financial tasks to consider:

– Stock Options: If you have stock options to exercise this year, have a strategy in place.

– Tax Planning: Consider what you can do differently for your 2023 taxes in 2024.

– Portfolio Diversification: Ensure you have enough diversification to cushion against market downturns.

Planning ahead and starting early helps you stay on track with your goals. Automating tasks and having a clear plan can make it easier to achieve your objectives.

Happy New Year!

Disclaimer

The information provided in this monthly blog post about the stock and bond market is intended for general informational purposes only and should not be construed as personalized financial, investment, tax, or legal advice. The content reflects the author’s opinions and analyses based on current market conditions and historical data, which are subject to change without notice.

Investing in the stock and bond markets involves significant risk, including the potential loss of principal. The strategies and viewpoints discussed in this blog post may not be suitable for all investors and should not be relied upon as the sole basis for making any investment decisions. Past performance is not indicative of future results. We strongly recommend that you consult with a qualified financial advisor, tax professional, or legal expert before making any financial decisions or implementing any financial strategies. Any decisions made based on the information in this post are solely at your own risk.