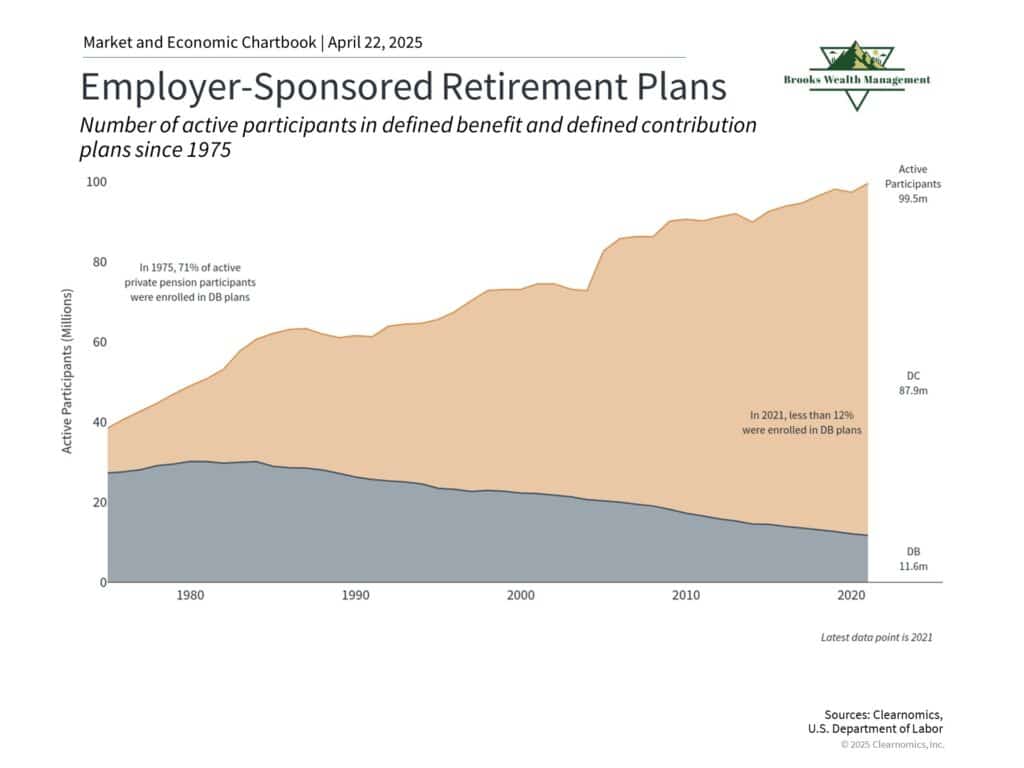

In 1975, more than 70% of private-sector workers were enrolled in defined benefit (DB) pension plans — the kind that provided a guaranteed paycheck for life after retirement. You put in your time, your employer funded the plan, and you could count on a steady income when you stopped working.

Fast forward to today?

That number has dropped to under 12%.

Instead, the vast majority of Americans — 88% — now save for retirement through defined contribution (DC) plans like 401(k)s. These plans shift the responsibility of saving, investing, and income planning from employers to individuals.

And here’s the hot take:

We didn’t just transition from pensions to 401(k)s.

We transitioned from guarantees to personal responsibility.

From employer-funded retirement to DIY planning.

That shift may not have been obvious at first. After all, both pensions and 401(k)s are “retirement plans,” right? But under the hood, they’re fundamentally different. Pensions are designed to take care of you. A 401(k) expects you to take care of yourself.

That means:

- You’re responsible for choosing investments.

- You bear the risk of market volatility.

- You have to navigate tax planning on your own.

- You must figure out how to turn your savings into income that lasts a lifetime.

This isn’t a doom-and-gloom message. But it is a call to action.

Pension Plans Aren’t Coming Back. So What’s Next?

Hoping that pensions return is like hoping Blockbuster makes a comeback — nostalgic, but unrealistic. Instead of wishing for the past, it’s time to prepare for the future.

If you’re a 401(k) holder (or planning to rely on any kind of personal retirement savings), it’s time to strap on your boots and get serious about what it means to be in the driver’s seat of your financial future.

And the good news? With the right strategy, education, and support, you can still retire with confidence. You just need a modern plan built for this modern retirement reality.

Want to Stay Ahead of the Curve?

I write a monthly newsletter packed with practical insights on retirement planning, tax strategies, Social Security, investment decisions, and more—designed to help working professionals make smarter financial moves.

If you found this post insightful, the newsletter is right for you.

👉 Click here to sign up for the Brooks Wealth Newsletter (It’s free. And helpful.)

Disclosure:

This article is provided for informational and educational purposes only and should not be construed as personalized financial advice. Brooks Wealth Management is a registered investment advisor in the state of Colorado. All investing involves risk, including the potential loss of principal. Always consult with a financial professional before making any investment or planning decisions.